Introduction to Bitcoin

- Feb 26, 2021

- 12 min read

Understanding Bitcoin on a deep technical level

Disclaimer: Content is summarised from Chapter 1 of 'Grokking Bitcoin' by Kalle Rosenbaum

Contents: 1. Introduction to Bitcoin

• What is Bitcoin? • The Big Picture • Problems with Money Today

• The Bitcoin Approach

• How is Bitcoin Used?

• Summary

1.1 What is Bitcoin?

A P2P digital cash system, with a free-floating exchange rate against most fiats. Thousands of computers keep the system working 24/7 & you just need internet & a computer program.

BTC Ecosystem

• End users: people using BTC for day-to-day needs e.g. savings, shopping, speculation, salaries

• Corporate users: companies using BTC to solve biz needs like paying wages internationally

• Merchants: e.g. restaurant or bookstore accepting BTC payments

• Bitcoin services: companies providing BTC-related services like topping up mobile phones, anonymisation services, remittance services, or tipping services

• Exchanges: commercial services people use to exchange local currencies to & from BTC

• Protocols on top: systems that operate “on top” of BTC to perform certain tasks like payment network protocols, specialised tokens & decentralised exchanges

• BTC developers: people working, often for free, with open source computer programs that participants of the BTC network use

Network processes payments, secures the ledger of who owns what from unauthorised modifications & gets new BTC into circulation at the predetermined rate. Network consists of computers around the world called nodes

1.2 The Big Picture

E.g. Alice wants to send 1 BTC to Bob

1. Alice creates & signs a transaction moving 1 BTC from her to Bob. She then sends the transaction to the network

2. Nodes check that Alice actually has the money to spend & that the transaction is authentic. They pass the transaction to their neighbours,”peers”

3. Each computer updates its own copy of the Bitcoin blockchain, “ledger”, with the new payment info

4. Network notifies Bob that he has received 1 BTC

Note: Alice does not really send 1 BTC to Bob, but asks the network to move 1 BTC from Alice to Bob in the BTC blockchain. BTC blockchain is a database that each computer in the network has a copy of. Think of the blockchain as a ledger of all transactions ever made.

Step 1: Transaction (payment)

Alice asks the network to move 1 BTC to Bob by sending a transaction to the network. This transaction contains instructions on how to move the BTC & a digital signature that proves it’s really Alice requesting that BTC be moved.

BTC transaction is a piece of data specifying:

1. Amount to move (1 BTC)

2. Recipient BTC address (Bob’s BTC address, 15vwoaN74MBeF5nr2BH4DKqndEFjHA6MzT)

3. A digital signature (made with Alice’s private key)

Digital signature is made from the transaction & a huge secret number, “private key”, that only Alice has access to. Digital signature could have only been created by private key’s owner. Alice’s mobile wallet app is connected to 1 or more nodes in the network & sends the transaction to those nodes.

Step 2: The Bitcoin Network

Alice has sent a transaction to 1 or more nodes. Each such node checks that the transaction is valid & passes it to its peers by consulting its local copy of the blockchain & verifying that:

1. BTC that Alice spends exists

2. Alice’s digital signature is valid

Step 3: The Blockchain

The word “Blockchain” comes from how ledger is structured: uses blocks that are chained together in a way that modifications to the blockchain can be detected. Nodes update their local copies of the blockchain with Alice’s transaction. Blockchain contains historic info about all previous transactions. New transactions like Alice’s, are appended to it every now & then. Updating the blockchain with Alice’s transaction is not straightforward: Potentially thousands of transactions can be in flight at the same time. If all nodes updated their copy of the blockchain as they received transactions, the copies would be different as transactions can come in different orders on different nodes.

To coordinate the ordering of transactions, 1 node takes the lead, saying “I want to add these 2 transactions to the blockchain in order Y, X!” This message, a “block”, is sent out on the network by that leader in the same way that Alice sent the transaction

As nodes see this block, they update their copy of the blockchain accordingly & pass the block on to their peers. Nodes that take the lead are rewarded with newly minted BTC & transaction fees in the block. But nodes will not constantly take the lead as to take the lead, they must solve a hard problem that requires nodes to consume considerable time & electricity (ensures leaders don’t pop up often). Problem is so hard that most nodes in the network don’t even try. Nodes that do try are “miners” as they mine new coins, similar to a gold miner digging for gold. Blockchain is append-only: transactions are added to the end of the blockchain only; grows only from the end.

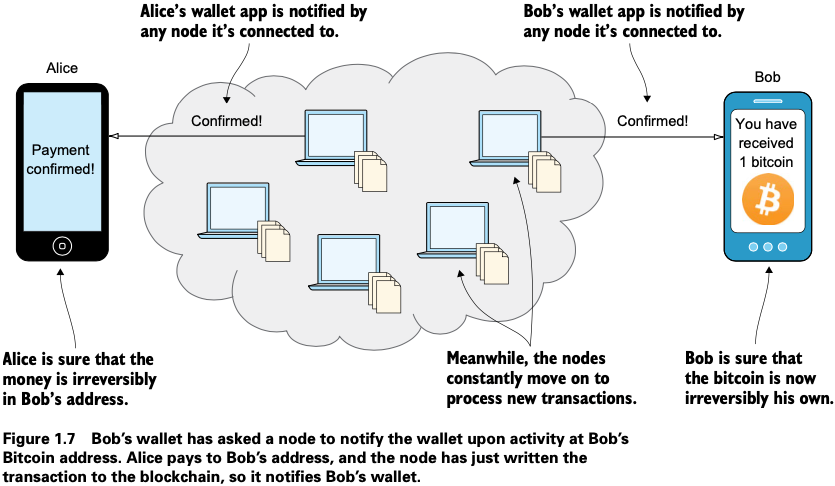

Step 4: Wallets

Bob & Alice are BTC network users & both need a computer program to interact with the network. Such a program is a “Bitcoin wallet”. Types of BTC wallets are on mobile phones, computers & there are specialised hardware wallet devices

Nodes update their local copy of the blockchain. Network needs to notify Alice & Bob that the transaction went through.

When a transaction concerning Bob is added to the blockchain, the nodes that Bob’s wallet is connected to will notify Bob’s wallet. Wallet displays a message to Bob that he received 1 BTC. Alice’s wallet will be notified of her own transaction. Bob’s & Alice’s wallets also manage their private keys for them. Private keys create digital signatures & generate a BTC address. When Bob later wants to spend what he received at his Bitcoin address (which he generated from his private key), he needs to create a transaction & digitally sign it with that private key.

1.3 Problems with Money Today

Segregation

According to the World Bank, ~38% of the world population does not have a bank account. Without a bank account & basic banking services like online payments, people can’t expand their businesses outside their local communities. People in rural areas might have to travel half a day to pay a utility bill or top up their prepaid mobile phone

Segregation between banked & unbanked people is driven by the fact that:

• Banking services are too expensive for some

• To use banking services, you need documentation like an ID card, that many people don’t have.

• Banking services can be denied to people with certain political views or those conducting certain businesses. Some might be denied service due to their ethnicity, nationality, sexual preferences, or skin colour

Privacy Issues

Electronic payments like credit cards or bank transfers, traditional money poses several privacy problems. States can easily: Trace payments, Freeze funds, Censor payments, Seize funds. Some may say, “I have nothing to hide, and the government needs these tools to fight crime.” Problem is: you don’t know what your government will look like in 5 years & how they define crime. New laws are just an election away. E.g. WikiLeaks was put under a blockade in 2010 where all donations via traditional channels like Visa & Mastercard were blocked after pressure from the US govt. E.g. Cyprus seized 47.5% of all bank deposits exceeding 100,000 € as part of a financial rescue program in 2013. Note that banknotes & coins usually aren’t affected. E.g. in Sweden, cash is being phased out, thus all your transactions will be recorded

Inflation

Inflation: decrease in purchasing power of a currency. E.g. of hyperinflation: Zimbabwean dollar inflated ~1023% from 2007 to 2008, peaking at 80 billion % per month during a few months in 2008 (hyperinflation is usually driven by a rapid increase in money supply). Governments sometimes increase the money supply to extract value from the population & pay for expenses like national debt, warfare, or welfare. If this tool is overused, the risk of hyperinflation is apparent. Depreciation of a country’s currency pushes people to exchange their local currency for goods / alternative currencies that better hold value, further driving down value of the local currency. Result is devastating for people as they see their life savings diminish to virtually nothing

Borders

Moving value across national borders using fiat currency is hard, expensive & sometimes forbidden. E.g. to send 1,000 Swedish crowns from Sweden to a person in the Philippines, you can use a service like Western Union for the transfer. A bank to bank transfer has a 4.9% fee. A typical remittance recipient will be able to receive only cash, which doubles or triples the cost to 10.5% or 16.3%.

1.4 The Bitcoin Approach

Decentralised

Control of BTC is distributed among thousands of nodes. No single node or group of nodes has more privileges or obligations. In a centralised system, the service is controlled by 1 entity that can decide who gets to use the service & what the user is allowed to do. E.g. an online video service can choose to provide a video only to people in a certain geographical location. In decentralised systems, it’s extremely hard to control who uses the system & how. BTC system treats all users equally & has no central point that can be exploited to censor payments, deny users service, or seize funds. BTC is permissionless; you need not ask anyone for permission to participate. Changing the rules of BTC is nearly impossible without broad consensus. If a node doesn’t obey the rules, all other nodes will ignore it. E.g. 1 rule is that BTC money supply is limited to 21M. There’s no one you can threaten or bribe to change these rules.

Limited Supply

BTC is resistant to high inflation as you can’t increase the money supply at will. BTC’s money supply is today increasing, at a diminishing rate, according to a predetermined schedule & will eventually stop increasing ~ 2140.

Borderless

As BTC is a system run by ordinary computers connected to the internet, it’s as global as the internet. Anyone with the internet can send money to others across the world. There is no difference between sending BTC to someone in the same room vs someone on another continent: money is sent directly to the recipient, who sees the payment nearly instantaneously. Within ~60min, this recipient can be sure the money is theirs. Once settled, the transfer can’t be reversed without the recipient’s consent.

1.5 How is BTC Used?

Savings

Keep your money safe by storing a set of private keys; secret pieces of info you’ll need when you want to spend your money. You choose how those private keys are stored: written on paper, stored electronically with a mobile app, memorised. By writing your key down, that piece of paper is now your savings account, your savings wallet. You can then send BTC to your wallet. If your private key is safe, your money is safe.

Cross-border payments

BTC can be used to avoid the expensive & slow legacy system for transferring money across borders. Some remittance companies offer services so that you pay e.g. Swedish crowns to the company & they pay out Philippine pesos to your friend (won’t even know that BTC is used under the hood). Such companies charge a few % for the service, but it will still be cheaper than traditional remittance services. If recipients can make good use of BTC where they live, there’s no need for a middleman (this is what BTC is all about)

Shopping

BTC’s borderlessness & security make it ideal for online payments for g&s. In traditional online payments: you send your debit card details to the merchant & hope they will withdraw as much as you agreed on & hope they handle your card details with great care. They probably store the details in a database. More merchants that store your details, the higher the risk.

Speculation

BTC can be alluring due to its price volatility. In Nov 2013, price climbed from ~$100 USD to more than $1100 in a few weeks. People FOMO’ed in driving the price further up, until it started dropping again. Drop to 50% of its peak value was just as quick as its rise. Same pattern repeated in late 2017 but at a greater magnitude. This has happened many times already. Fluctuations like this are rarely driven by specific news or tech advancement, but usually arise from speculation. Speculation can be fun, if you can afford to lose, but it’s more like a lottery than something to make a living from. Sometimes a government or big corporation makes a negative statement about BTC that creates fear, but those events tend to have a limited effect on bitcoin’s value. BTC price volatility seems contradictory to the claims of it having a non-inflationary property; a 50% drop in market value appears pretty inflationary. BTC is still relatively new & lots of short-term speculation causes this volatility. But as Bitcoin grows & more people and institutions start using it to store their wealth, it will probably stabilise in the long run, & its deflationary property will emerge over time

Non-currency Uses

(i) Ownership

BTC lets you embed small pieces of data with payments. E.g. This data can be a chassis number of a car. When the car leaves the factory, the manufacturer can make a small BTC payment to the new car owner, containing the chassis number. This payment will then represent the transfer of ownership for that car. BTC payments are public records tied to long strings of numbers; “public keys. The car manufacturer has made its public key available on its website to tie the key to the manufacturer’s identity. New owner can show ownership of the car by proving that she owns the private key belonging to the public key to which the manufacturer has transferred ownership. New owner can sell the car to someone else & transfer ownership by sending the same BTC she got from the manufacturer to the new owner’s public key. Public can follow the car’s ownership from the manufacturer through every owner’s public key.

(ii) Proof of Existence

Using the same technique to store data in a BTC payment to transfer ownership of a car, you can prove that a document existed prior to a certain point in time. Digital documents have a fingerprint: a cryptographic hash that anyone can calculate from that document. Creating a different document with the same fingerprint is practically impossible. Fingerprint can be attached to a BTC payment & is recorded in the BTC blockchain. You “anchor” the document in the blockchain. BTC payments are public records, so anyone can verify that the document existed before the time of the payment by taking the document’s fingerprint & comparing it to the fingerprint stored in the blockchain.

How is BTC Valued?

Several BTC exchanges exist, most are internet-based. They resemble stock markets, where users wanting to sell BTC are matched with users wanting to buy BTC. Different markets can have different market prices depending on SS & DD in that market. E.g. in countries like Venezuela, where the government tries to hinder the BTC market, SS is low. But the DD is high as people want to escape their hyper-inflating currency thus BTC is priced up in that market compared to US & European markets, where people can trade more freely

When not to use BTC

(i) Tiny Payments

BTC transactions usually include a processing fee. As BTC network’s cost for processing a transaction depends mostly on how big (in bytes) the transaction is, fee does not depend on the amount sent. Fee also depends on SS & DD for available space in the blockchain. Blockchain can’t handle more than ~ 12 MB of transactions per hour, thus miners sometimes have to prioritise transactions. Higher fees will probably give your transaction a higher priority. If fee is a significant share of the actual payment, it isn’t economically viable to pay with ordinary BTC transactions. Promising emerging tech is being built on top of BTC e.g. Lightning Network, which allows for cheap, instantaneous micropayments of tiny fractions of BTC. Could potentially pay just 100 satoshis (1 satoshi = 0.00000001 BTC) at a fee of as little as 1 satoshi.

(ii) Instant Payments

BTC payments take time to confirm. Recipient sees the payment immediately but shouldn’t trust the payment until the BTC network confirms it, which happens ~ 20min. Trusting an unconfirmed transaction can be risky; the sender can double spend the BTC by sending the same BTC in another transaction to another BTC address. Confirmation time can add friction in brick-and-mortar shops as customers don’t want to wait 20min before getting their coffee. Some online services like pay-per-view, could find the confirmation time problematic. This limitation can also be fixed by systems built on top of BTC e.g. Lightning Network.

(iii) Savings you cannot afford to lose

Things could go bad with BTC, as in the following scenarios:

• You lose your private keys

• Your government tries to crack down on BTC users by imprisonment or other means of force

• Price of BTC swings down dramatically due to rumours or speculation

• Software bugs make BTC insecure

• Weaknesses arise in the cryptography Bitcoin uses

Although all these risks are possible, most of them are unlikely. The list is somewhat ordered with the most likely at the top. Always weigh the risks before putting money on the line.

Other Cryptos

Cryptocurrencies other than BTC are often referred to as alt-coins, meaning alternative coins. Thousands of other alt-coins exist. Some provide unique features that aren’t available in BTC & others provide little to nothing innovative. Some alt-coins may even be outright scams. Anyone can create an alt-coin by taking existing cryptocurrency software & modifying it to their needs. E.g. Sheila wants to start an alt-coin, Wowcoin. She takes the BTC software & changes the max money supply to 11,000,000. If she wants Wowcoin to have some real value, she must convince others to begin using it but if she’s not providing anything innovative, she’s going to have a hard time getting other people on board. Think of it as starting a new internet, Wownet. People on Wownet won’t be able to use services on the internet. Conversely, people on the internet won’t be able to use your service if you’re on Wownet. So why would anyone use Wownet? This is the network effect: people tend to go where other people are & thus (crypto)currency becomes more useful as more users use it. Though some interesting alt-coins are out there, it’s hard to tell which of these will survive long-term.

1.6 Summary

• Bitcoin is global, borderless money that anyone can use with the internet

• Many actors use Bitcoin; savers, merchants & traders for purposes like payments, remittances & savings

• A network of computers, the Bitcoin network, verifies & keeps records of all payments

• Steps for a transaction: send transaction, verify transaction, add transaction to the blockchain, notify recipient & sender wallets

• Bitcoin solves problems with inflation, borders, segregation & privacy by providing limited supply, decentralisation & borderlessness

• Thousands of alt-coins exist

• Network effect: a (crypto)currency becomes more useful as more users use it

Comments