Trading Vehicles

- Jun 27, 2020

- 24 min read

Updated: Jul 3, 2020

Trading vehicle charts may look similar on a screen, but don’t let their looks deceive you.

Disclaimer: content is summarised from Part 8 (Chapter 42 - 47) of 'The New Trading for a Living: Psychology, Discipline, Trading Tools and Systems, Risk Control, Trade Management' by Alexander Elder

Contents:

1. Stocks

• Be a Contrarian

• Number of Stocks

2. Exchange-Traded Funds (ETFs)

• The Hidden Market & the Losing Market

• The Hidden Transaction

• Fees & Manipulation

• Poor Tracking

3. Options

• Intro to Options

• Buying Options

• Writing Options

• Writer's Choice

• Limiting Risk

• Can Option Buying Be Intelligent?

4. Contracts For Difference (CFDs)

5. Futures

• Futures & Cash Trades

• Hedging

• Supply, Demand & Seasonality

• Floors & Ceilings

• Contango, Inversion & Spreads

• Commitments of Traders

• Margins & Risk Control

6. Forex

• Broker is the Enemy

• How to Forex

• Currencies Moving Around the Clock

Ensure your trading vehicle meets 2 essential criteria: liquidity & volatility. Liquidity: average daily volume, compared with other vehicles in its group. Higher liquidity means easier entry & exit of trades. E.g. build a profitable position in an illiquid stock, only to lose at the exit due to bad slippage as so few people trade that your own sales may lower its price.

Volatility: extent of average short-term movement. Higher volatility presents more opportunities. Popular stocks tend to swing a lot. Stocks of many utility companies that are quite liquid but hard to trade due to low volatility hence they usually stay in narrow ranges.

"Beta" compares any vehicle’s volatility to its benchmark, like a broad index. If a stock’s beta is 1, its volatility is equal to that of S&P 500. Beta of 2 means that if S&P rises 5%, stock is likely to rise 10%. Beginners should focus on low beta vehicles.

Time Zones: Think twice before trading far away from your time zone. If you trade while sleepy, you put yourself at a disadvantage.

Long / Short: markets go up & down. Beginners only buy, but pros are comfortable with selling short. Profit is difference between higher selling & lower buying prices.

1. Stocks

A stock is a certificate of ownership of a business. If others want to own that business, they bid for your shares. If outlook / prospect of business is good, stock prices rise, vice versa. Public companies have incentive to increase share prices to help raise more equity / issue debt & top execs’ bonuses are often tied to stock prices.

Fundamental values like earnings drive prices in long run, but some stocks of new sexy industries levitate on expectations of future earnings rather than real profits. Stocks of solidly profitable, well-run companies may not trend up if crowds are not excited about their outlook.

Be A Contrarian

Buffett calls the market a manic-depressive fellow. Ignore offers from the market & only buy at bottoms (depression) & only sell at peaks (manic). Idea is brilliant in its simplicity, but hard to implement. Market’s mood is contagious & people want to sell when market is depressed & buy when manic. Be a contrarian. Define objective criteria to decide how high is "too high" and how low is "too low". Buffett uses fundamental analysis & a fantastic gut feel. Traders can use tools of technical analysis.

Number of Stocks

With over 20,000 stocks in US alone, beginners should focus on only a handful & increase if trader hones the skill of trading & has the time for it. Elder's friend has 200 stocks on his watch list & reviews them on weekends, selecting < 10 for the upcoming week. Elder has 2 groups, on weekends he runs the 500 component stocks of S&P 500 through his divergence scanner & focuses on stocks flagged, selecting a few for the upcoming week. He will also review Spike picks on weekends, to "piggyback". No. of stocks he focuses on during the week is always in single digits.

2. Exchange-Traded Funds (ETFs)

ETF is an investment vehicle that trades like a stock. Different ETFs hold different types of assets like stocks / commodities / bonds. They usually trade close to their net asset values (NAV). Leveraged ETFs are designed to move 2x / 3x distance of underlying index. Inverse ETFs & leveraged inverse ETFs trade opposite to their underlying assets (index falls, inverse ETF rises, vice versa). Leveraged ETFs are more “futures-laden” than non-leveraged ETFs & have much greater rollover losses each month. Disadvantages that retail investors suffer are magnified in leveraged ETFs. Only ETFs that trade decently are broadly based ones like SPY & QQQ. ETFs attract many unsophisticated retail clients; admin fees & poor tracking of underlying securities disadvantage them. When it comes to ETFs; buyer beware.

The Hidden Market & the Losing Market

2 ETF markets: primary market is reserved for “authorised participants”; large broker-dealers who have agreements with ETF distributors to buy / sell large blocks, consisting of tens of thousands of ETF shares. These middlemen buy at wholesale & sell to you at retail. You, the private trader will be in the secondary market.

The Hidden Transaction

Elder's friend claims that 'authorised participants’ can obtain ETF shares to short in large lots. Elder's broker says none are available, not even broadly held ETFs. When he asks about this, they stonewall. He wonders how such a shorting transaction by an authorised participant is accounted for & if it somehow ends up as paired transactions (both an up-volume purchase & a down-volume sale, cancelling each other out). If so, the added selling pressure would be hidden from view.

Fees & Manipulation

Admin expenses incurred by ETFs dampen investor returns. Study by Morgan Stanley: ETFs missed 2009 targets by average of 1.25%, 2x size of their “miss” in 2008. Those percentages are your fees for trading ETFs rather than individual stocks. More exotic index tracked by an ETF leads to greater fees. Some ETFs lose value so fast that issuers repeatedly perform reverse splits to raise prices back into double digits. With the passage of time, those ETFs sink back into single digits, & issuers perform another reverse split to appeal to new losers.

Poor Tracking

Many ETFs “track” underlying indexes in a shabby manner. Elder's friend lost over a million dollars in 2013: when he anticipated a market decline & bought an ETF of a volatility index (volatility rises when markets fall).

$VIX (volatility index) & VXX (volatility ETF) weekly. (Charts by Stockcharts.com)

The 2 charts are supposed to track the same thing. Volatility is an important factor in market movements. Prices oscillate between uptrends & downtrends & also oscillate between periods of low & high volatility. Hence, analysts monitor $VIX; volatility index. Left chart shows $VIX oscillating between low teens & mid-twenties. Traders have a saying: “when VIX is high, it’s safe to buy; when VIX is low, go slow.” Since $VIX fluctuations appear fairly orderly, some trade it using ETFs like VXX, on the right. During the same time, VXX has steadily declined, losing 90% of its value. How’s that for tracking volatility?

In another e.g. market dropped 10% & volatility spiked but his ETF went down instead of up. Elder's commodity ETFs went down as the underlying commodity went up. Elder stopped trading country ETFs the index would rise to a new high, while his ETF would stay well below breakout level.

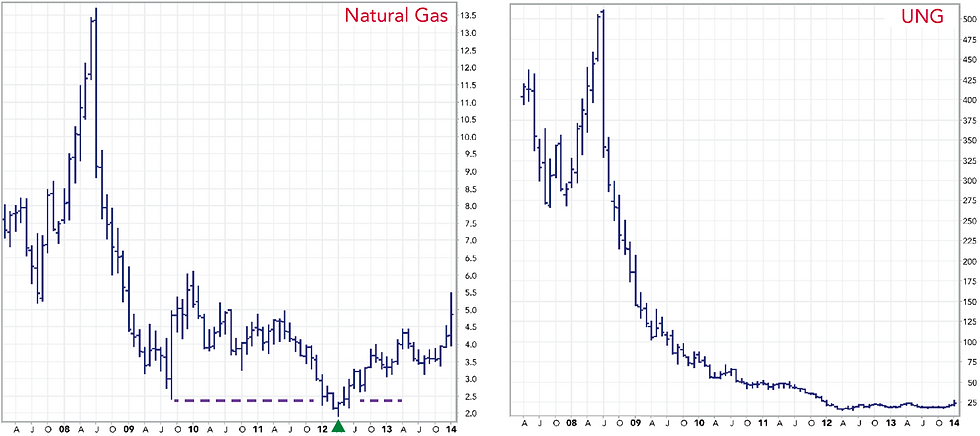

Natural Gas Spot & UNG, a natural gas ETF, monthly. (Charts by Stockcharts.com)

Left chart shows prices of natural gas spot market. It tops out near $13.5 in 2008 & began a bear market ending with a double bottom. False downside breakout near $2 in 2012 (green triangle) identifies a buying opportunity. A futures chart (not shown) looks very similar to the spot chart but look at UNG, natural gas ETF on the right. As it slid from above $500 to below $20, many clients complained of losing money trying to pick its bottom.

3. Options

Intro to Options

An option is a derivative instrument; bet that another security like stock / index / future will reach a certain price by a certain date. Call gives the holder a right, not an obligation, to buy a certain quantity of a certain security at a certain price at a certain time. It is a bet on a price increase. Put is a right, not an obligation, to sell a quantity of a security at a price at a time. It is a bet on a price drop. There are 2 parties in every options trade: buyer & seller (aka writer). Buyers buy options, writers create options & sell them to buyers.

Being a Writer

Note that option buyers as a group lose money over time, despite occasional lucky trades. Option writers as a group make steady money despite occasional losses. Writers create options out of thin air to meet demand from option buyers. Elder's student describes options: "Options are a hope business. You can buy hope / sell hope. I am a professional: I sell hope. I come to the floor (of the American Stock Exchange) in the morning & find what the public hopes for. Then I price that hope & sell it to them.”

Each option has an exercise price (aka strike price). If a stock fails to reach that price before exercise date, option expires worthless, buyer loses what he paid & writer keeps his loot (aka premium)

At / Out / In-the-Money

Option is at-the-money when current price of underlying security equals exercise price.

Call is out-of-the-money when current price of underlying is below exercise price. Put is out-of-the-money when current price of underlying is above exercise price.

Call is in-the-money when current price of underlying is above exercise price. Put is in-the-money when current price of underlying is below exercise price.

Option can be at / out / in-the-money at different times as price of underlying security varies. Price of every option has 2 components: intrinsic value & a time value.

Option’s intrinsic value is positive when it’s in-the-money. If exercise price of a call is $80 & underlying security rises to $83, intrinsic value of call is $3. If security is at / below $80, intrinsic value of call is $0.

If stock trades at $74 & $2 is paid for an $80 call, $2 represents time value. If stock rises to $83, & price of call jumps to $4, $3 is intrinsic value ($83 – $80), while $1 is time value (the hope that stock will rise even higher during remaining life of option).

Factors Affecting Option Prices

Farther out-of-the-money exercise price = cheaper option: underlying must travel a longer distance to make option worth anything before it expires.

Closer to expiration day = cheaper option as there is less time to fulfil the hope. Rate at which option loses value is “time decay” which becomes steeper as expiration nears.

Less volatile underlying = cheaper option as it has a smaller chance of making a large move.

Minor factors include level of interest rates & dividend rate of underlying stock.

Factors may clash & partly cancel each other out. E.g. market drops sharply, reducing value of calls, increased volatility lifts option values, & calls may lose less than expected. Mathematical models like Black-Scholes are used to determine "fair value" of any option.

Buying Options

Simplest & easiest approach is to buy options, which is what beginners do. Brokerage house propaganda goes: “Options offer leverage: ability to control large positions with a small outlay of cash. Traders make money fast when they are right, & if market reverses walk away & owe nothing!” However, to profit from buying an option you must be right in 3 ways: pick the right stock, predict extent of its move, & forecast how fast it gets there. Money is lost if you are wrong on any one of these 3 choices.

A stock / index / future can do 1 of 3 things: rise / fall / stay flat. Profit from buying a call if market rises fast enough. Profit from buying a put if market falls fast enough. A pro sells a call & if a stock drops / stays flat / rises slow enough call will expire worthless, & seller keeps premium.

Disadvantages of Buying Options

Options attract hordes of traders who cannot afford to buy stocks & buy calls as substitutes. This does not work as options move differently from stocks. Beginners, gamblers & undercapitalised traders make the bulk of option buyers. Majority of their money will go to option writers, with the rest to brokerage commissions. Option writing is capital-intensive: you need min. of hundreds of thousands to do it right & most successful writers operate with millions. Markets sucks money from the poorly informed majority, into wallets of a savvy minority. Options are a great example of the rule of smart traders looking for situations where majority does something one way, while a small, moneyed minority does the opposite.

Writing Options

2 main types of option writing: covered writers buy a stock & write options against it, naked writers write calls & puts on stocks not owned.

E.g. covered writers: fund holds IBM stock & sell calls against it. If stock does not rise to exercise price during those calls, options will expire worthless. Covered writer adds premium to the fund & write a new call with a new expiration date. If IBM rises to exercise price & “gets called”, they will deliver their stock at its strike price, collect the money, & use the freed-up capital to buy another stock & write calls against it.

Large funds tend to use computeriSed models for buying stocks & writing covered calls. Covered writing is mathematically demanding & capital intensive hence it favours players spread costs, like staff & equipment, across a large capital base. A small trader is at a disadvantage. Covered writing is now crowded & returns have become thinner.

Naked Writing as a Viable Option

Naked writers back up writes with cash in accounts. A naked writer collects premium when opening a trade, but risk is unlimited if position goes against him. Covered writers have something to deliver if stock rises to exercise price & gets called. Naked writers will have to pay if stock rises to / above exercise price.

Combo of limited rewards & unlimited risks scares most traders away from naked writing. A far-out-of-the-money option with a short time to expiration is likely to expire worthless, hence writer will profit. Risk / reward ratio in naked writing is better than it looks & there are techniques to reduce impact of a rare adverse move.

Savvy naked writers sell not just hopes but distant hopes. Track volatility to find likely range of movement of a stock & sell options outside of that range.

Reduce risk exposure by closing positions without waiting for expiration dates. E.g. If you write a call at $0.90 & it drops to $0.10, buy it back & unwind your position. Cheaper to pay another commission, secure profits & look for another writing opportunity.

Naked writers require discipline. Size of writes & no. of positions must be strictly determined by money management rules. Decide beforehand, at what level to cut & run, taking a smaller loss by quitting before it is too late.

Writer's Choice

Time is the enemy for options buyers as they lose when underlying takes longer than expected to get reach exercise price. Time works in the favour of writers. Option written loses some of its time value each day, making premium more likely to be collected. When market goes nowhere money is still made as time value keeps evaporating.

Steps Before Writing

1. Analyse underlying security. Use Triple Screen to decide whether a stock / future / index is trending / non-trending. Use weekly & daily charts, trend-following indicators & oscillators to identify trends, detect reversals & set up price targets. Do not hold open positions during potentially stormy days like when earnings are about to be announced.

2. Select type of option to write. If analysis is bearish, write calls. If bullish, write puts. Do not write options when markets are flat & premiums low as a breakout from a trading range can hurt you.

3. Estimate how far (with buffer) stock would have to run in order to change trend. Write an option beyond that level.

Time Decay

Time Decay Options lose value with each passing day, but rate of decay is not steady. Options drop faster as expiration date draws closer.

Time decay is bad for option buyers & very good for option writers. Premium is collected the day a call is sold. Premiums are safer as options fall below price at which they are written.

Sweet spot for option writers is ~ 2 to 3 months from option expiration. That is when time decay gathers speed & it accelerates in the last few weeks. Writing options closer to expiration allows for faster time decay. Goal of writer is to grind out steady income hence, do not be greedy and go for options closer to expiration even if options with longer lives can get you more money.

Delta

Delta is a tool that shows probability of underlying reaching exercise price by expiration date.

Cautious option writers aim to sell calls / puts with Delta not much above 0.10. This means there is 10% chance of hitting exercise price before expiration date. If 10% risk seems high, note that Delta is derived without any reference to market analysis. If your decision is based on good technical analysis, your risk is lower than what Delta indicates.

Temptation to sell naked options closer to the money and get fatter premiums is dangerous as Delta is likely to be high hence a slight counter trend move will result in loss.* (how is delta derived)

Limiting Risk

Slicing bid-ask spread: put a low bid / a high ask, then give up 1 penny a time till somebody bites. E.g. based on Elder's friend's experience: you want to write (sell) an option. Bid is $1.18 & ask $1.30, but no intention to sell at $1.18 & pay huge spread. Order to sell a large number of contracts at $1.29 & with no response, a few min later, lower ask to $1.28. Buyer shows up & bid-ask spread went back to $1.18/$1.30. There are large traders watching from sidelines, not showing their hand, but willing to trade within the spread. Get them to bite by giving up a penny at a time.*(how does this work)

3 Ways Option Writers Get Hurt

Some overtrade, creating positions too large for their accounts. Some fail to exit before an option moves against them. Lastly, they can get blown out if they do not have a reserve against a major adverse move. Longer you trade, the greater the risk of a catastrophe.

Protecting Trades

Protect all trades, including naked options. Suggestions:

1. Set profit-taking zone: consider buying back naked options. Buyer of your option that has fallen far from exercise price still has chance that market may reverse in his favour. As a writer, do not hold open positions that have already reaped most of its potential profit. After option loses half of its value, consider buying it back to close profits. Exit trade by the time an option loses 80% of value.

2. Use a mental stop-loss on option sold. Use mental stops as pros fish for stops of thinly traded options. Using mental stops requires discipline. Set mental stops on underlying & option. E.g. sell a naked option 80 call on a stock trading at 70 & place mental stop at 75. Exit before it is too late & set a stop on your option: if price is doubled, buy it back to cut losses. E.g. sold option for $1.50, buy it back if it reaches $3 to avoid “unlimited loss”.

3. Open an insurance account for if you trade long enough, anything can happen like market crashing day after you write a put / takeover after you write a call. Open a money market account & throw 10% of profits into that account after every profitable close on naked writing. Avoid trading on this account to prepare for catastrophic loss / to be taken out in cash when you stop writing options. E.g. Elder told a client to send 10% of profits to the bank holding mortgage on his country house, using that prepayment as his insurance fund.

Can Option Buying Be Intelligent?

Pros may buy puts only when they expect severe drops. Buying puts sidesteps the problem of setting stops on shorts when extreme volatility hits the market.

Prices tend to fall 2x faster than rise. Greed (uptrends) is a lasting feeling while fear (downtrends) is sharper & more violent. Pros are more likely to buy puts due to shorter exposure to time decay. Best put to buy is different from what most will buy.

1. Estimate how low a stock will collapse. Put is only worth buying if you expect a crash.

2. Avoid puts > 2 months left. Better to sell short underlying if you anticipate a drawn-out downtrend

3. Look for cheap puts whose price reflects no hope. Lower strike = cheaper put. Drop down strike prices till you reach a level where you would only save a fraction of a put’s price. This shows that all hope has been squeezed out of that put & is priced like a cheap lottery ticket. Buying a very cheap, far-out-of-the-money put is counterintuitive as it is so far & has little life left before expiry. With these, you aim for a tenfold gain / better. Such returns allow you to be wrong 3,4,5 times in a row, yet come out ahead in the end. You just need to catching those infrequent major reversals to profit. It requires lots of patience & most cannot stomach idea of being wrong 3-5 times in a row.

4. Contracts For Difference (CFDs)

CFD is a bet on future value of a currency / index / stock. Buyer of CFD collects difference from company that sold contract if price of underlying rises & pays the difference if price falls. CFDs are derivatives that allow speculators to bet on rallies / declines & are similar to spread betting (both are illegal in US) Institutional traders began using CFDs to hedge stock exposure & avoid taxes. Firms marketed CFDs to retail traders late 1990s, touting their leverage & exemption from UK taxes. CFDs are contracts between individual traders & providers, who may offer different deal terms. Each CFD is created by opening a trade with a provider, based on underlying. Be prepared to pay large bid-ask spreads, commissions & overnight financing. Trades are mostly short-term though positions can be taken overnight. Financing charges & profits / losses are credited / debited daily. CFDs are traded on margin.

Advantage is that small min. sizes of contracts allows accessibility. Absence of expiration dates means there is no time decay. Financing is charged on longs & is paid out on shorts.

Disadvantages: commissions are high relative to contract sizes. CFD issuers control bid-ask spreads & prices of contracts, which may deviate from prices of underlying. A retail customer plays against a pro team that can move the goal posts during the game.

CFDs are heavily marketed to new & inexperienced traders, extolling their potential gains, while glossing over risks. Australian financial regulator ASIC considers trading CFDs riskier than gambling on horses / in casinos.

5. Futures

A future is a contract for delivery of a quantity of a commodity by a certain date at an agreed-upon price. Futures contracts differ from options by being binding on buyer & seller. In futures you cannot walk away if you would like in options (where buyer has right, not obligation). If market goes against you, get out of trade at a loss / add to your margin. One advantage of futures is that they are stricter than options, but their responses to market volatility are smoother, hence easier to trade. Also, there are not many futures, hence easier to track. Stocks tend to move as a group, while many futures move in unrelated trends, offering more trading choices.

Wheat is a commodity, while bread is not as it includes multiple components. In recent decades, many instruments began to trade like commodities: stock indexes, bonds & currencies. Futures include financial instruments along with traditional commodities.

Buyer of a stock becomes a part owner of a company, but buyers of futures contracts do not own anything. Buyers enter a binding contract for a future purchase of merchandise, like wheat / Treasury bonds. Seller of contract assumes the obligation to deliver. Money paid for a stock goes to seller, but in futures your margin money stays at the clearinghouse as a security, to ensure you will accept delivery when contract comes due, hence margins is aka “honest money”. In stocks you pay interest for margin borrowing, in futures you can collect interest on your margin funds. Each futures contract has a specific size & a settlement date. Most traders close out contracts early, settling profits & losses in cash. Existence of a delivery date forces people to act.

Most futures have daily limits where prices cannot exceed so as to interrupt hysterical moves & give people time to rethink positions. String of limit days can be very stressful when a losing trader is unable to get out while account is being ground down. Globalisation of futures markets has created many emergency exits, allowing you to unwind a trade elsewhere. Careful traders identify emergency exits before they are needed.

In stocks, most buy & few sell short. In futures (just like options), size of long & short positions is always equal. Survival rate for new futures traders is low: 9 in 10 bust out in the first few months. Understand that the danger is not in futures but in a gross lack of risk-management skills among beginners. Futures offer some of the best profit opportunities to serious traders.

Futures & Cash Trades

Cash trade: e.g. February, gold trades at $1,500 per ounce, & analysis indicates likely to rise to $1,575 within weeks. With $150,000, you can buy a 100-oz gold bar from a dealer & store it in a safe. With correct analysis, sell for $7,500 profit / 5% before commissions. If you trade futures based on the same analysis.

Futures trade: April is the next delivery month for gold. 1 futures contract covers 100 oz of gold. Margin to trade contract is $7,500 hence you can control $150,000 worth of gold with a $7,500 deposit. If analysis is correct, you make roughly same profit as cash trade, but with return of 100% on investment instead of 5%.

Many see such numbers & feel a surge of greed & buy multiple contracts. Trader with $150,000 in account can afford 20 contracts but there is a catch.

Markets seldom move in a straight line. Analysis may be correct, but it is perfectly possible to dip to $1,450 along the way. $50 dip would create a $5,000 paper loss in a cash trade but a wipeout for a futures trader with multiple contracts. His broker would demand more margin, & if he has no reserves, broker will sell him out at a loss. Beginners buy too many contracts & get wiped out due to overcommitting equity with very thin reserves: poor money management. Beginners should stick to stocks as futures benefit traders with strong money-management skills & discipline.

Hedging

Futures serve an important economic function: they permit commercial producers & consumers to hedge commodity price risks, giving them a competitive advantage. Futures offer speculators a gambling palace with more choices than any casino.

Hedging means opening a futures position opposite to one’s position in the actual commodity. Good hedging buys price insurance & serves as a profit center. Hedgers transfer price risks to speculators lured by the glitter of potential profits. Irony of hedgers who have inside info & are not fully confident about prices, while crowds of outsiders bet loads on futures. 2 largest groups of speculators are farmers & engineers. Farmers produce commodities, while engineers apply scientific methods to the futures game. Many farmers enter as hedgers but start speculating.

Consumer Hedging

E.g. major candy manufacturer knows months in advance how much sugar they will need. They buy sugar futures & & plan to sell when they buy cargoes of sugar. If sugar prices rise, loss is offset with same profit on futures position. If sugar prices fall, losses on futures contracts are offset in savings on raw materials. Unhedged competitors are taking chances. Hedged consumers concentrate on running their core businesses, insulated from future price swings. Airlines know years in advance how much jet fuel they need, & buy oil futures.

Producer Hedging

Producers of commodities also benefit from hedging e.g. agribusiness pre-sells wheat, coffee / cotton when to assure profits. They sell short enough futures contracts to cover the size of their prospective crop. If prices drop, losses are offset by profits on short futures trades. If prices rise, losses on short futures are offset by selling the actual commodity at higher prices.

Hedging removes price risk from planning to buy / deliver a cash commodity. It allows commercial interests to concentrate on their core businesses, offer stable consumer pricing, & obtain a long-term competitive advantage.

Supply, Demand, & Seasonality

Futures are driven by supply / demand. Demand-driven markets tend to be quiet & slow. Changes in demand come slowly due to conservatism of human nature. Demand for coffee increases only if drinking is more popular & demand can drop if coffee drinking is less popular, due to a recession / response to a health fad.

Supply-driven markets tend to be fast & furious. Supply of coffee due to hurricanes / crude oil due to new OPEC policies / copper due to strike in copper-mining country is reduced / even rumoured to be reduced, thus price shoots up.

Once harvest is in & supply is known, demand is the driving force. Demand-driven markets have narrower channels, smaller profit targets & lower risks. As seasons change, redraw channels & adjust trading tactics.

Know key supply & demand factors of your futures market. E.g. monitor weather during critical growing & harvesting months for agricultural commodities. Trend traders for futures look for supply-driven markets, while swing traders do just as well in demand-driven markets.

Most commodities vary by seasons. Freezing spells in US are bullish for heating oil futures. Orange juice futures used to have wild run-ups during frost season in Florida, but have become much more sedate due to production in Brazil in the Southern hemisphere. Seasonal trades take advantage of such swings, but be cautious as those cycles are seldom identical. Seasonal trades should be vetted with technical analysis.

Floors & Ceilings

Commodities, unlike stocks, rarely trade below price floors / above price ceilings. Floor depends on cost of production. When price of commodity falls below that level, production falls. Some third-world governments, desperate for dollars may subsidise production, paying locals in a worthless local currency & dump the product on the world market. Supply still drops if enough producers quit & prices rise. 20-year chart of most commodities shows that the same price areas serve as a floor.

Ceiling depends on cost of substitution. If price of a commodity rises, major industrial consumers switch away from it.

However, floor & ceiling is not set in stone & markets may briefly violate them. Human nature also works against those trades. Most do not have courage to short a market boiling near record highs / long a market after a crash.

Contango, Inversion & Spreads

Contango

All futures markets offer contracts for different delivery months. E.g. buy / sell wheat for delivery in September / December, etc. Normally, nearby months are cheaper & that relationship is called a contango market.

Premiums & Inversions

Higher prices for later delivery dates reflect “cost of carry”: financing, storing & insuring a commodity. Premiums are the price difference between delivery months. When supply tightens / demand increases, people pay up for nearby months & premium for faraway months shrinks. Market is inverted when front months are more expensive than faraway months. Inverted market is a very strong sign of a bull market in a commodity.

Note that interest rate futures market is the only market where market inversions are the norm as those who hold cash positions keep collecting interest instead of paying finance & storage charges. Pros do not wait for inversions but monitor premiums.

Spreads

Hedgers dominate short side of markets while most speculators are perpetual bulls, but floor traders love to trade spreads. Spreading means buying a delivery month & selling another in same market. It also is to long one market & short a related one.

If price of corn starts to rise faster than price of wheat, ranchers will reduce purchases of corn & buy more wheat, pushing their spread back towards the norm. Spread traders bet against deviations & for a return to normalcy. Spreader will short corn & buy wheat.

Spread trading is safer than directional trading & has lower margin requirements. "There is not a single book on spreads I can recommend, a sign of how well professionals have sown up this area of knowledge and kept the outsiders out."

Commitments of Traders

Brokers report client positions to Commodity Futures Trading Commission (CFTC), which releases summaries to the public. Their Commitments of Traders (COT) reports provide info on what smart money does in the futures markets.

COT reports reveal positions of: hedgers, big traders & small traders. Hedgers identify themselves to brokers for advantages like lower margin deposits. Big traders hold no. of contracts above “reporting requirements”, set by the government. Small traders make the rest.

Big traders used to be the smart money but hedgers are today’s smart money, though understanding their positions is hard.

E.g. COT report may show hedgers holding 70% of shorts in a market. This may not be bearish as hedgers may normally hold 90% of shorts in that market, making the 70% stance wildly bullish. Compare current positions to historical norms, looking for situations where hedgers are on one side, with small traders on another. Then, use market technical analysis for entries on side of hedgers.

Margins & Risk Control

Futures’ low margin requirements makes them more rewarding than stocks but more dangerous. When buying stocks in US, put up at least half of cash value with broker giving you a margin loan for the rest. E.g. $40,000 in account, you may buy max. of $80,000 worth of stocks. Margin limit was implemented after 1929 Crash since low margins led to excessive speculation, which worsened declines.

Margins

Margins of only 3 to 5% are common in futures markets, allowing traders to make huge bets with little money. With $40,000, you may control a million worth of merchandise. Futures are very tradable if you follow strict money management rules. Pros put on small initial positions & pyramid them if a trade moves in their favour. They add new contracts while moving stops beyond breakeven.

Beginner Markets

Start with markets where you know something about fundamentals e.g. cattle rancher, a house builder, a loan officer --> cattle, lumber, interest rate futures. If you have no particular interests, start with relatively inexpensive markets. In US, corn, sugar & in a slow year, copper can be good markets for beginners. They are liquid, volatile & not too expensive.

Mini-Contracts

Futures traders with small accounts sometimes trade mini-contracts. E.g. regular contract of gold represents 100 oz & mini-contract covers 20 oz. Mini-contracts trade during the same hours as regular contracts & closely track prices. Commissions are similar, taking a proportionately bigger bite from each trade. Slippage tends to be bigger due to lower volumes except for stock index futures, where mini contracts have higher volumes.

6. Forex

Forex market is the largest asset class in the world by trading volume. Currencies trade around the clock—from Monday 04:15 SGT to Saturday 02:00 SGT. Some trades serve hedging needs of importers & exporters but most transactions are speculative.

Forex market has no central location. Institutions deal in the interbank market, trading using online platforms like Bloomberg / Reuters. Unless you can trade $10 million of spot forex at a pop, retail trade via a broker.

Broker is the Enemy

When trading stocks / futures / options, broker is your agent who executes trades for a fee. In forex, your broker is likely to take opposite side of every trade (enemy). Forex house that buckets your orders wants you to lose, so that it can win. In addition to shifting bid-ask spreads & charging interest on non-existent positions, they may charge a daily “resettlement fee”: full bid-ask spread for every day you hold a trade. They go to the legitimate market only when multiple client orders cluster on same side of same currency pair in excess of a million, which is when they hedge exposure in the real market. Forex houses makes clients lose with homicidal leverages like 100:1 & 400:1. Slightest price wiggle is guaranteed to wipe out client equity hence they keep clients’ money in-house, never moving trades to the real market to keep the loot to themselves. “The market has long been plagued by swindlers preying on the gullible,” according to The New York Times. “The average individual foreign-exchange-trading victim loses about $15,000, according to CFTC records,” writes The Wall Street Journal. Currency trading “has become the fraud du jour,” according to Michael Dunn of the U.S. Commodity Futures Trading Commission. In Jan 2010, CFTC identified a “number of improper practices” in retail forex market, “among them solicitation fraud, a lack of transparency in the pricing and execution of transactions, unresponsiveness to customer complaints, and the targeting of unsophisticated, elderly, low net worth and other vulnerable individuals.”

How to Forex

Real forex market is a zero sum game. Well-capitalised pros, many of whom work for banks, devote full-time attention to trading. Inexperienced traders have a huge info disadvantage. Retail trader always pays bid-ask spread, which lowers his odds of winning. Being undercapitalised also means higher probability of going bust in long run. Elder says he enjoys trading currencies, but trade at electronic currency futures rather than a forex house as futures brokers work for you, not against you. Futures spreads are more narrow, commissions more reasonable & no interest is charged for holding a position. There are regular contracts & mini-contracts for major currency pairs.

Currencies Moving Around the Clock

One challenge of currencies is that they move around the clock. If you plan to take profits the next morning, the turning point you saw coming may have come & gone. Major financial institutions deal with this problem by using system of “passing the book.” A bank may open a position in Tokyo, manage it intraday, then transfer it to its London branch before closing for the night. London continues to manage & in the evening passes the book to New York, which manages it until it passes it back to Tokyo. Currencies follow the sun & small traders cannot keep up with it. Either take a very long-term view & ignore daily fluctuations / day-trade & avoid overnight positions.

Comments